Walking through the world of child care can be daunting, particularly when it comes to grasping the financial implications. For numerous families, the expense of childcare is a significant financial burden that can strain budgets, making it crucial to investigate available support options. One of the most effective tools to help families estimate their potential savings is the Childcare Subsidy Calculator. This handy resource enables parents to determine their assistance in a few minutes, providing insight on how much support they might get.

In this manual, we will take a step-by-step method to utilizing a Childcare Subsidy Calculator. Whether you are a employed parent or preparing for the school year, this estimator can help you get a clearer picture of your childcare expenses and how subsidies may affect your overall budget. By knowing what information you'll require and how to avoid common errors, you can make the most of this valuable tool to make sure your family receives the support you need.

Understanding Childcare Financial Aid Calculators

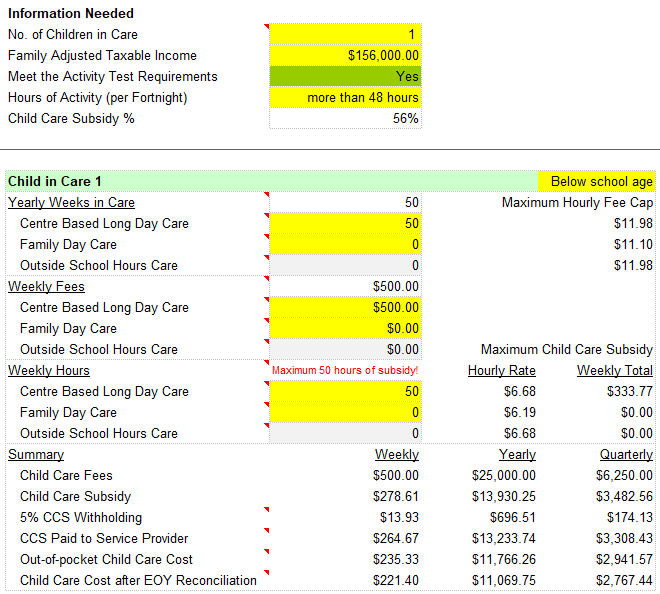

Child care subsidy calculators are valuable resources intended to help families assess their potential financial assistance for childcare costs. These calculators typically take into account various factors such as family income, family size, and the particular child care services needed. By inputting relevant information, caregivers can receive a rapid estimate of the benefits they may qualify for, providing a more detailed picture of their monetary situation regarding childcare costs.

Utilizing a childcare subsidy estimator can greatly influence budgeting for those with children. It supports caregivers understand how much they could save on child care and early education costs and enables them to consider various childcare options based on their estimated monetary assistance. This not only assists in planning but also promotes improved financial management by allowing families to allocate resources more effectively.

It is important to recognize that these calculators are designed to make easier the task of calculating child care subsidies. They provide an easier alternative to manual calculations, which can often be complex and time-consuming. http://decoyrental.com/members/ccsestimator791/activity/1280504/ may account for multiple qualification criteria and local regulations, making certain that families receive a customized calculation based on their unique circumstances.

Using the Estimator to Maximize Benefits

To make the most of your Child Care Subsidy Estimator, it's important to gather the required data prior to beginning. This comprises your family's income, the number of children in requirement of care, and the varieties of child care services you are considering. Being accurate and thorough in inputting this information will help the estimator give you with the optimal possible results. Remember, even minor discrepancies in your reported earnings or care costs can cause significant changes in the support amount you qualify for.

After obtaining your initial estimate, it is beneficial to explore various child care choices locally. The estimator allows you compare expenses across various types of care, such as daycare centers, in-home care, or preschool programs. By using the tool to assess the financial implications of each choice, you can identify which arrangements align most effectively with your budget and enhance your benefits. This forward-thinking approach can save your family money while continuing to offer quality care for your child.

Finally, think about updating the Child Care Subsidy Calculator from time to time, especially when there are changes in your financial circumstances, such as a new job or a change in income. Regularly updating your information can help you adjust your budget well and ensure you are consistently receiving the benefits you are entitled to. This consistency is important for working parents who may have fluctuating schedules and expenses, and keeping your estimator results up-to-date can result in optimal savings throughout the year.

Typical Errors and Methods to Eliminate Them

One of the top errors families commit when utilizing a Child Care Subsidy Estimator is failing to accurately assess their household income. It is important to consider all sources of income when evaluating eligibility and potential benefits. This can encompass wages, bonuses, child support, or any other financial support. By ensuring that all income sources are included, families can obtain a more accurate estimate of their potential subsidy.

Another typical mistake is overlooking to update information when there are modifications in family circumstances. Child care needs can fluctuate significantly with new job situations, adjustments in work hours, or an increase in family size. It is vital to reevaluate eligibility regularly, especially at the beginning of every school year or when other significant life changes take place. Keeping your information revised will help avoid any surprises and ensure that you are getting the correct benefits.

In conclusion, some families ignore the importance of researching different child care options before using an estimator. Child care costs can differ widely depending on the type of care chosen, such as daycare, preschool, or at-home care. Using a Child Care Subsidy Estimator to evaluate different care options can show the best financial fit, ensuring that families achieve the most benefit from their subsidies. Taking the time to assess these options can lead to more educated decisions and greater overall savings.